China Seeks Banned Nvidia Chips

When the U.S. unveiled its ambitious semiconductor export controls in October 2022, it marked a pivotal moment in the global tech war—a modern-day echo of the Cold War arms race. Today, that ripple effect continues to grow as China seeks banned Nvidia chips, fueling an aggressive push to expand its AI capabilities despite tightening U.S. restrictions. This scramble has placed Nvidia’s high-end AI chips, once common tools in AI development, at the center of a geopolitical standoff.

Chinese Tech Firms Find Workarounds for Nvidia Chip Shortage

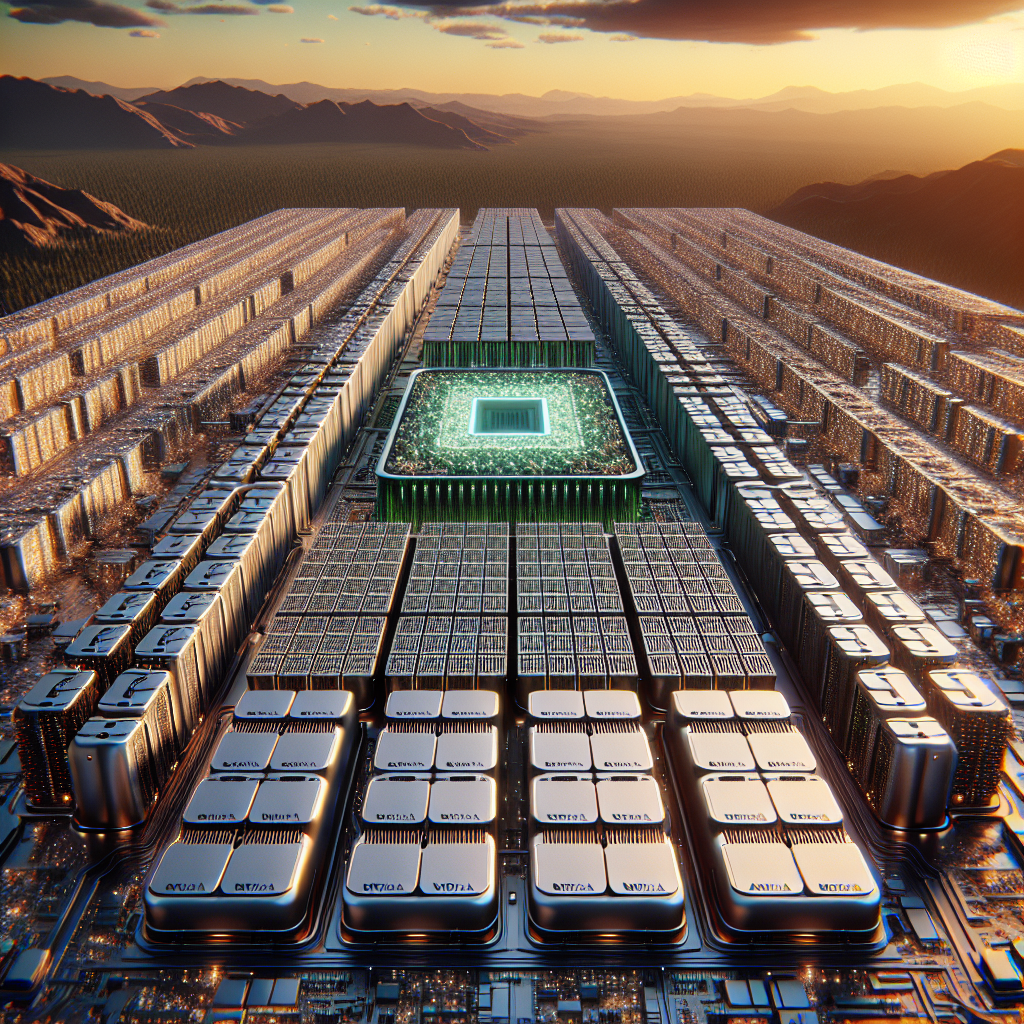

Recent reports suggest that Chinese cloud and data center companies are maneuvering around U.S. export bans to secure tens of thousands of Nvidia’s most advanced AI chips—specifically, the A100 and H100 models. According to sources cited by TipRanks, Chinese firms are attempting to procure as many as 115,000 banned Nvidia chips.

While these chips are barred from direct export to China under current U.S. laws, Chinese enterprises are reportedly leveraging resellers and alternative import channels in places like India, Taiwan, and Singapore to bypass restrictions.

Why China Wants Nvidia’s Chips

The banned Nvidia chips play an essential role in powering cutting-edge artificial intelligence models. Their parallel processing capabilities drastically reduce the time and energy financial, technological, and governmental institutions need to analyze large datasets.

China’s motivation for these chips is twofold:

- Accelerating AI Development: Chinese tech companies such as Alibaba, Tencent, and Baidu are aiming to catch up or surpass Western competitors in generative AI and language model development.

- Powering Supercomputing Data Centers: These Nvidia GPUs are vital for the performance of China’s large-scale data centers, which serve as the infrastructure backbone for AI, big data, and cloud computing applications.

U.S. Export Bans Spark Global Supply Chain Shifts

The Biden administration’s raw determination to restrict AI chip exports is part of a broader effort to curtail China’s military and surveillance use of advanced technology. This has caused global chipmakers to reconsider supply routes and business strategies, triggering widespread changes in the semiconductor ecosystem.

In response, Nvidia introduced less powerful alternatives, such as the A800 and H800 models, tailored specifically for the Chinese market to comply with U.S. regulations. However, these models are still seen as insufficient for training large AI models and running complex simulations—leading to China’s newfound urgency to acquire the original versions through unorthodox means.

China’s AI Ambitions Face Uncertain Future

As China seeks banned Nvidia chips, the overarching tension between innovation and regulation is becoming more pronounced. The United States’ move is not just about halting the flow of hardware; it’s about delaying an AI-driven future in China. Meanwhile, the Communist Party is doubling down on self-sufficiency in chip design and production, investing billions into its semiconductor ecosystem.

Yet, catching up won’t be easy. Nvidia’s expertise in hardware and software integration for machine learning continues to give Western companies a considerable head start. The focus now shifts to how long China can sustain its appetite for banned technology—and whether Western regulators can shore up the cracks forming in trade enforcement.

Conclusion

The geopolitical chess game between the U.S. and China is increasingly being played not with tanks and missiles but with 7nm chips and neural networks. As China seeks banned Nvidia chips to power its AI ambitions, the global tech industry is watching closely—because who controls the data, often controls the future.